A fresh document that distilled spirits income have been growing at a fee that outpaced beer earnings growth turned into tremendous to hear. As fresh investors in Brown-Forman corporation (NYSE:BF.A) (NYSE:BF.B) we consider we could be set to see revenue growth speed up. according to the Beverage suggestions group's instruction manual boost 2016, 2015 became the nineteenth consecutive 12 months on quantity increase for distilled spirits. in fact, within the ultimate ten years US exports have more than doubled.

click to enlarge

click to enlarge

Brown-Forman is a company that few may understand by identify, however many will understand via its brands. It was based in 1870 and has developed up a fine portfolio of leading alcohol beverage manufacturers which encompass Jack Daniel's whiskey, Finlandia vodka, and Southern consolation. besides the fact that children the latter is being offered off to Sazerac in a $544 million deal.

Let's get straight to the sale of Southern comfort. even though it is a recognizable company, earnings have been struggling. within the most fresh quarter earnings of Southern comfort slumped by 7%, due mostly to the increasing recognition and availability of Sazerac's own option, Fireball Cinnamon Whiskey. We consider the deal works for both parties and enhances Brown-Forman's strategy of freeing itself of challenged manufacturers, in addition to non-core manufacturers. It did the same factor 9 years ago when it offloaded its wine business, and we are assured this stream should be just as a hit.

click to magnify

click to magnify

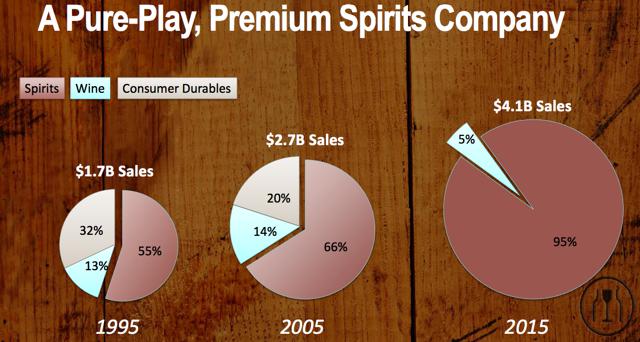

supply: company Presentation

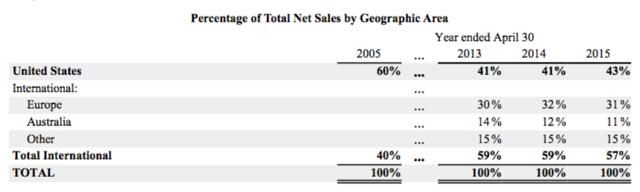

The mentioned increase in distilled spirits could ease the drive being felt by using foreign money headwinds because it is positioned extraordinarily neatly to benefit following its evolution to a pure-play top class spirits enterprise, because the graphic above demonstrates. furthermore, within the most contemporary annual document the business stated its belief that the market for American whiskey is turning out to be even quicker than complete distilled spirits globally. This could be very useful as like many businesses in identical industries Brown-Forman has struggled with the amazing US dollar. here's due to the reality the company has carried out a fine job within the final ten years of growing its foreign company. As proven below you could see how it has evolved from 40% of sales coming internationally, to fifty seven% nowadays.

click to amplify

click to amplify

source: Annual document FY 2015

Let's no longer overlook although that currencies do exchange in time. That which is a headwind nowadays, may be a very potent tailwind in a number of years' time. We do not expect this to turn up very immediately, actually we are expecting things will get worse before they get more desirable lamentably. the U.S. dollar will doubtless find its legs in opposition t most foremost currencies again later this yr after a short hiccup lately. So, for now, extended demand will deserve to be the motive force for earnings growth and we think confident it may be. earnings growth is really what shareholders are craving, as in recent quarters it has simply begun to run out of steam.

we're very completely happy with the amazing nature of the business's steadiness sheet. This has allowed the enterprise to embark on a $1 billion share buyback software which became recently introduced. Its powerful balance sheet, along side the proceeds from the Southern consolation and Tuaca sale and its becoming cash movement, will permit it to continue to return capital to shareholders. exquisite news for shareholders

click on to magnify

click on to magnify

supply: Ycharts

youngsters the shares are a bit on the costly side now in comparison to where it might normally alternate (shown above), we consider the company will record amazing increase in revenue ahead of consensus this fiscal year which justifies the perceived top rate. we're forecasting income per share of $3.60 in comparison to the analyst estimate of $three.forty five, and subsequent year we are expecting profits per share of $three.ninety on salary of $four.forty five billion. at last, as earnings increase delivery to grow modestly, we might are expecting the shares to exchange at around 27 times salary. however this might possibly be a great few years as we see revenue growing to be through 10% each year for the subsequent five years. This forecast excludes any weakening of the us dollar. When the us greenback does ultimately weaken it could be a huge catalyst to additional profits growth in our view.

we've a one-12 months cost goal of $117 for Brown-Forman, giving upside of simply over 7%. however like lots of our investments we see greater long-term good points for affected person investors. We nevertheless feel the increase of whiskey has an awful lot left within the tank, and may keep the business's distillery extremely busy in the next few years.

Disclosure: i'm/we are long BF.A.

I wrote this text myself, and it expresses my very own opinions. i am not receiving compensation for it (apart from from in search of Alpha). I have no company relationship with any enterprise whose stock is mentioned in this article.

沒有留言:

張貼留言